Breadcrumb

- Home

- Frequently Asked Questions

Frequently Asked Questions

General

What is the minimum capitalization threshold?

The capitalization threshold for moveable equipment (6730) and IT equipment (6731) is $5,000 including installation and shipping. The software (6740) capitalization threshold is also $5,000 for UIHC, but $500,000 for the rest of the University. Any capitalized asset must also have a useful life of more than one year.

Departments may use the non-capital equipment tracking template for equipment below the capitalization threshold, or their own system or spreadsheet.

What costs can be capitalized?

Starting fiscal year 2010, equipment costing more than $5,000 or software costing more than $500,000 (UIHC is $5,000 for equipment and software) with a useful life of more than one year can be capitalized. Capitalizable costs include the cost of the item as well as costs paid to a vendor for freight, installation, set-up, and/or testing. These same costs are used to determine if an expenditure meets the $5,000 or $500,000 minimum cost for capitalization (it must also have a useful life of more than one year).

- The asset capitalized is an item and components that can stand-alone are not part of the asset (exception: system assets at UIHC).

- Software that is not intrinsic to hardware cannot be considered in conjunction with the cost of hardware to meet the capitalization test.

- Software is capitalizable on a “per seat” license cost basis.

Note: Warranties, service contracts, and training are not capitalized expenses.

Am I required to track equipment that doesn’t meet the minimum threshold?

No. Some departments already have their own processes to track equipment that falls below the minimum capitalization threshold, such as laptops, desktop computers, and cameras. Capital Asset Management is not designed to replace these processes, and departments are not required to use this service.

How can I track equipment that does not meet the minimum capitalization threshold?

The University of Iowa capitalizes and tracks equipment costing more than $5,000 and useful life greater than one year as capitalized assets. These assets are purchased on I/act 6730, 6731, or 6740. Assets that can bear the University’s metal bar-code tag are tagged. Other assets are tracked in the asset management system (PSAM) by serial and/or accession numbers.

The University also purchases equipment that does not meet the threshold for capitalization. This includes items that a department may wish to track on its own records, such as laptops, desktop computers, and cameras. Departments may already track some of these pieces of equipment. For departments that would like to track non-capitalized equipment, Capital Assets Management (CAM) provides the following services:

Tags

CAM can provide a campus department with a gold tag, which shows University ownership only.

Contact Capital Assets Management by email to request gold tags (please indicate number of tags needed and campus mailing address).

Template to Track Equipment

You may also use the Excel Template to help track non-capitalized equipment. This template is a generic tool and can be modified as needed.

CAM does not track non-capitalized inventory or monitor template usage.

What if I have equipment that meets the threshold and looks like it should be tagged but does not have an asset tag affixed to it?

If the equipment was purchased, email Capital Assets Management and provide a Purchase Order or Voucher number by which the asset was purchased. CAM can then correct the original expenditure (IACT), assign a tag number, and send the tag and “tag card” to the department.

If the equipment was acquired by gift, re-titled to the University by a Federal Agency, or received from another institution, please complete an Additions Form. CAM will add the asset and assign a tag number for the equipment.

What is useful life, how is it determined, and how can I request a change?

Useful life is the length of time that a depreciable asset is expected to be useable. It is based on a profile for that group of assets.

For the University of Iowa Hospitals and Clinics (UIHC), useful life is based on American Hospital Association guidelines.

For assets outside UIHC, the useful life of a profile of assets is based on average, expected use.

If you believe that an asset should have a useful life different than its assigned life, email Capital Assets Management with a rationale for changing it.

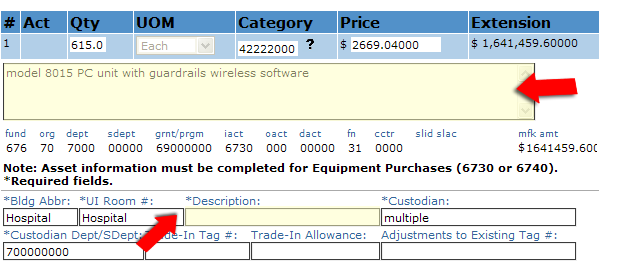

What information do I need to provide on the PReq?

When a Requestor chooses an IACT of 6730, 6731, 6737, or 6740, the PReq provides fields for additional information that is used to set-up the asset. The Requestor should complete all applicable fields:

UI Building and Room #

Where the asset will be housed.

Asset Description

The PReq has a new Description field to be used in the purchase of equipment and software. As before, requestors continue to have an area to communicate purchase of an item with the vendor. This area may include vendor catalog numbers that are not relevant for asset description.

Because the vendor description may not be useful in describing the resulting asset, a second Description field was added within the asset information area to allow Requestors to communicate asset descriptions to the Capital Assets Management Office.

General guidelines for this new Description field are:

- Enter “Noun” “Manufacturer or Model” “Description” where

o “Noun” is the item being purchased

o “Manufacturer” or “Model” – based on which is more relevant to identifying the asset.

o “Description” provides additional specifics concerning what type of item is being purchased - If there are multiple line items associated with an asset or quantities of the same asset, enter the same description in the Asset Information area for all associated line items.

- Freight does not need a description in the Asset Information Area.

Example:

Requestor is purchasing two types of pumps on a PReq:

- Line 1: Ordering 615 Model 8015 PC unit with guardrails wireless software.

- Line 2: Ordering 100 Syringe and software

- Line 3: Ordering 615 Auto-ID module; software

- Line 4: Ordering 615 Auto-ID module handheld scanner

- Line 5: Implementation charge associated with Model 8015

Line items 1, 3, 4, and 5 are associated, so the asset description for all 4 lines should be the same. In this case, both types of assets are pumps, so additional information concerning model and/or type is necessary to differentiate the two types of assets.

Result:

- Lines 1, 3, and 4 are described as “Pump Control Unit 8015”.

- Line 2 is described as “Pump Syringe 8110”.

Custodian and Custodian’s Dept/Sub-dept

The person responsible for the asset.

Trade-In

What assets, if any, are being traded-in for this purchase.

Adjustments to Existing Tag #

Provide tag # of the existing asset if this purchase adds to an asset currently in the asset management system.

What should I put for an asset description?

An asset's description is an extremely important part of identifying that asset for staff in your department and well as others, especially when conducting a physical inventory. The description is entered on the PReq in the location / description / custodian section. You have 30 characters to describe the asset. Start with a noun such as "microscope", then add other descriptors as you have room. Helpful descriptors besides the noun include the brand, model, or other functionality.

I work at UIHC. Why don't your procedures cover me? Where do I go to get information?

University of Iowa must comply with accounting standards written by the Governmental Accounting Standards Board (GASB). UIHC Orgs 03, 65, 70-89, 93 and 94 are covered under UIHC Asset Capitalization Policy (UIHC Login Required) that follows FASB (Financial Accounting Standards Board) and AHA (American Hospital Association) guidelines and rules, in addition to those of GASB.

What IACCT should I use?

See full list from Accounting Code Manual

EQUIPMENT

Greater than $5,000

6730 – Equipment, non-IT >$5k

6731 – Equipment, IT >$5k

Less than $5,000

6081 – Computers & Smart Devices <$5k

6082 – Printers, Peripheral Devices <$5k

6083 – Server, Networking, Storage <$5k

6085 – Equip Purchases non-capital <$5k

SOFTWARE

Purchased not Cloud-based

6080 – Software, non-capital <$500k (or <$5k for UIHC)

6740 – Software, capitalized >$500k (or >$5k for UIHC)

LEASES

6737 – Lease, capitalized (equipment, building, software, or land that meets the GASB 87/96 definition)

6407 – Lease, IT Software Maintenance & Fees (doesn't meet GASB 96 definition and/or below $250k total cost)

6430 – Lease, non-capitalized (doesn’t meet GASB 87 definition and/or below $1M total cost threshold)

6480 – Lease Taxes

6400 – Lease insurance

What are GASB 87 and 96? see FAQ

Purchases of supplies, equipment repairs, and building repairs

6199 – other supplies (there are many supply accounts)

6260 – Repair and Maintain Buildings (requires building cost center)

6265 – Repair and Maintain Equipment, including Warranties and Service Contracts

Shipping

6245 - Freight not included on supply or equipment invoices. Charge those freight costs to the supply or equipment account.

What are GASB 87 and 96?

GASB (Governmental Accounting Standards Board) 87 and 96 are pronouncements pertaining to Leases and Subscription-Based Information Technology Agreements (SBITA) respectively. The Controller's Office has established the following lease and SBITA guidelines for what is to be considered a GASB lease/SBITA at the University of Iowa:

- Greater than one year, including extensions

- Total lease cost contract amount over $1M for a lease or $250k for a SBITA

- Cannot be cancelled without cause by both parties (lessor and lessee)

- No variable costs

What are Export Controls and how do they affect the usage, transfer, and/or shipment of equipment?

Please see the University of Iowa Export Control home page for further information, or contact the Export Control Coordinator in the Division of Sponsored Programs at export-control@uiowa.edu.

Asset Tags and Tagging

What is an asset tag and what is its purpose?

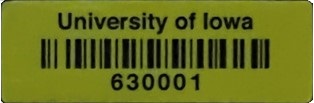

Prior to 2021, an asset tag is a silver metallic tag (or yellow vinyl replacement label) that is permanently affixed to equipment that serves to identify it for tracking, inventory, and accountability purposes. The 6-digit identification number is recorded by the Capital Assets Management office as part of the University’s asset database (PSAM). The corresponding serial and model numbers, if present, are also part of the asset record. A bar code on the tag can be electronically scanned when doing a physical inventory.

In 2021, Radio-Frequency Identification (RFID) asset tags were introduced to help aid in the inventory process. They are similar in shape and size to the traditional silver metallic tags previously used, but are yellow in color and utilize a radio signal that is generated as a response to the RFID reader’s signal to identify the tag to the reader.

RFID Asset Tag Example

What is a "tag ahead"?

A "tag ahead" is the assignment of a tag number prior to the payment for the asset, i.e., prior to the time the tag is normally assigned.

"Tag aheads" are best used when a group of assets arrive in a department's central receiving area where tags can be applied and the “tag sheets” verified prior to distribution of the assets.

Who affixes the tag to the asset?

The Capital Assets Management office will send a staff member out to tag and photograph whenever possible. Alternatively, the tag may be sent via campus mail to the listed custodian of the asset, or the individual designated as having responsibility for the department's assets when Capital Assets Management staff is unable to tag the asset in person. When tags are sent, the departmental personnel receiving the tag is responsible for properly affixing the tag to the asset, verifying the information provided on the "tag sheet", and returning the “tag sheet” to Capital Assets Management.

Who assigns the tag number and when is it assigned?

Capital Assets Management assigns the tag number for all equipment and software assets when the asset is set-up in the University's asset database (PSAM). Assets are usually set-up shortly after the voucher for the assets have been paid.

Trade-ins

What is a Trade-in?

A trade-in is an asset that is picked up or sent to the vendor in return for a proceed amount applied to the purchase of a new asset. The asset must actually leave University possession in order for the proceeds of the trade-in to be applied to the value of the new asset. If the trade-in asset is retained by the University, the proceed amount initially offered by the vendor will be treated as a discount on the new asset.

Can an asset be handled as a trade-in after the new asset has been recorded in Asset Management?

No, the traded asset must be worked in the University's asset database (PSAM) at the time a new asset is being entered.

Can more assets be traded-in than are being purchased?

No, it must be a one-to-one association between them, i.e. one asset traded for one new asset purchase. Additional assets traded-in, however, may be entered on the PReq. The additional assets used in the trade-in will be retired in the University's asset database (PSAM).

What form do I use for a trade-in asset?

Trade-in assets must be listed in the PReq for the new capital assets in the Trade-In Tag # box. If more assets are being traded in than Trade-In Tag # boxes available, please list the tag number in the PReq Comment section or as an attachment. The amount of proceeds for each trade-in provided by the vendor in the Trade-In Allowance box, Comment section, or the attachment on the PReq.

The new equipment will be capitalized at its total value, rather than cost less the trade-in. The value of the trade-in offsets net book value for the asset traded-in.

Capital Asset Inventory

Who is responsible for physical inventory?

The Department Administrator listed on the Budget Officer Institutional Roles is responsible for the completion and certification of the physical inventory for the department.

The Inventory Contact listed on the Capital Assets Management Institutional Roles is responsible for inventory verification and preparation of deduction, surplus, or transfer workflow forms.

When and how often is physical inventory required?

According to the University of Iowa Policy Manual, all departments with equipment and software assets must verify them biennially.

University of Iowa Hospitals & Clinics inventories capitalized equipment and software annually.

Federal assets must be verified on an annual basis. This count is performed each spring in order to have reports available for federal auditors at year-end. There are also additional counts that may be required by State of Iowa Auditors Office, Departments, or the Capital Assets Management Office.

Federal Assets

What is a Federal Asset?

Equipment purchased with funding by Federal Agencies shall be either the property of the University or the Federal Agency according to the terms of the award as determined by the Grant Accounting Office. For federal-funded assets where title remains with the Federal Agency and for federal-furnished assets, the equipment is classified as "Federal-Titled" on the University's asset database's (PSAM) Federal Asset page.

Note: a federal asset is also known as a “Government-owned” asset.

How do I know if I have a Government-owned Asset?

Federal-funded assets where title vests with a Federal Agency should be noted on the P-req. Capital Assets Managment should be notified of the addition of federal-furnished assets via the “Statement of Government-Owned Equipment Status” by the equipment’s Custodian or contract’s Principal Investigator.

Capital Assets Management will note “federal-title” status in the asset management records and send a tag denoting the Federal Agency to the Custodian. The Custodian applies this tag near the University bar code tag.

In addition to the “Agency tag”:

For Federal-furnished equipment, Capital Assets Management will send the equipment’s Custodian a vinyl tag with the designation “GFE0” to be affixed directly to the left of the University bar code tag. Special treatment of Government-owned equipment may be required to fulfill specific requirements of the Federal Agency grant or award. Normally, these “Government Tags” are furnished directly to the Principal Investigator, who is responsible for placing the tag on the equipment and notifying Capital Assets Management. Capital Assets Management is responsible for entering the tag information on the University's asset database's (PSAM) federal pages.

Reports

How do I access CAM reports?

You must have a HawkID to access CAM reports. It is available through the Data Access section of the Administration page of the Employee Self-Service site or from the Capital Assets Management home page.

You may also contact CAM staff for the most comprehensive information, contact at CAM@uiowa.edu and someone will get you the information you need as quickly as possible.

What asset reports are available?

Asset Detail Search

Search for assets by asset identification number, tag number, serial number, or PO number. Returns details including acquisition date, accounting date, transaction date, cost, custodian information and location.

Active Asset Look-Up

Search for active assets by department, sub-department, custodian, building, location, profile, and grant number.

Asset Management Report

Report asset cost and MFK information for equipment and/or software (see cost type) by department, sub-department and date range of all assets, categorized by additions and adjustments, Transfers and Recategorizations, and Retirements and Reinstatements.

Other Reporting Inquiries

Please contact us at CAM@uiowa.edu for any reporting needs.

Where can I get a list of my departmental assets?

Please email Capital Assets Management to have use run a departmental listing at a departmental or department/sub-department level by providing a department number.

What if I need information not available on the standard CAM reports?

Standard CAM reports provide information concerning equipment and software assets only, and it does not provide information concerning depreciation. Please email us at CAM@uiowa.edu if you have specialized reporting requirements.

How do I...?

Can I do an equipment CV?

Yes, because Change Vouchers (CVs) move expenditure, they can be done in the year of acquisition as long as you do not change the IACT to or from a 6730, 6731, 6737, or 6740. Thereafter, to move assets between Departments and Sub-Departments, complete an “Internal Transfer of University Equipment Form”.

How do I change equipment IACT's when they are wrong?

Please contact Capital Assets Management. If it meets capitalization guidelines, Capital Assets Management will CV the expenditure and send you documentation via e-mail or campus mail.

How do I change the Departmental Representative to whom CAM sends physical inventory materials?

Contact Capital Assets Management to update our records.

How do I get a new tag when a vendor replaces an asset?

When a vendor replaces an asset at no cost for a new asset of like nature, email Capital Assets Management to request a new equipment tag. Include in the email the tag number and any changes in model or serial #’s that has resulted in the equipment exchange.

How do I...Form/Action?

Add asset: found in dept; title transfer in with arriving faculty; donated; acquired from government agency?

Change asset custodian or location?

- No form needed -- email Capital Assets Management

Close out a department that has a balance in IACTs 1630 through 1685?

- There are assets in the dept. They will need to be transferred, deducted (if not found), or sent to Surplus. Complete the appropriate form. At the end of the month, transactions will zero out balances in the GL.

Document off-campus use of UI property?

Fabricated asset - Establish?

- No form needed -- email Capital Assets Management

Get approval for my Department to sell an asset?

- Contact University Surplus

Get Replacement tag?

- No form needed -- email Capital Assets Management

Purchase an asset?

- Complete a Preq (purchase requisition)

Remove asset approved for sale (by University Surplus) and sold by Department?

Remove asset from department inventory?: Equipment used for parts; Equipment Stolen; Missing after two Inventory cycles

Request a tag-head?

- No form needed -- email Capital Assets Management

Request Surplus pick up of assets and/or other equipment?

Trade-in asset for new equipment?

- No form needed -- enter tag number and serial number (if available) on PReq when ordering new asset

Transfer asset ownership to another UI Department or Sub-department?

Transfer assets accompanying departing faculty to another institution?

- If assets were purchased by an active research grant, on fund 500 or 510, and that research grant is being transferred to another institution, use Title Transfer Form

- If assets were purchased on non-Fund 500 or 510, it is property of the University of Iowa and must be sold through University of Iowa Surplus, use Surplus Disposal Request Form